Crypto as a Service (CaaS): Key Benefits, Providers, and Use Cases

Dive into CaaS with our guide. Discover insights, benefits, and challenges for informed crypto decisions.

Since the company’s inception on June 11, 2013, AlphaPoint has always been one of the ‘early believers’. We believed that bitcoin (and its derivatives) would revolutionize finance in a similar way to how the internet revolutionized communication, and we are proud to have been at the forefront of that wave.

Our technology enables our customers to launch marketplaces. These marketplaces allow customers to create, trade, and store digital assets. Powering our customers’ ventures has provided a unique viewpoint into the regional evolution and adoption of this transformative technology.

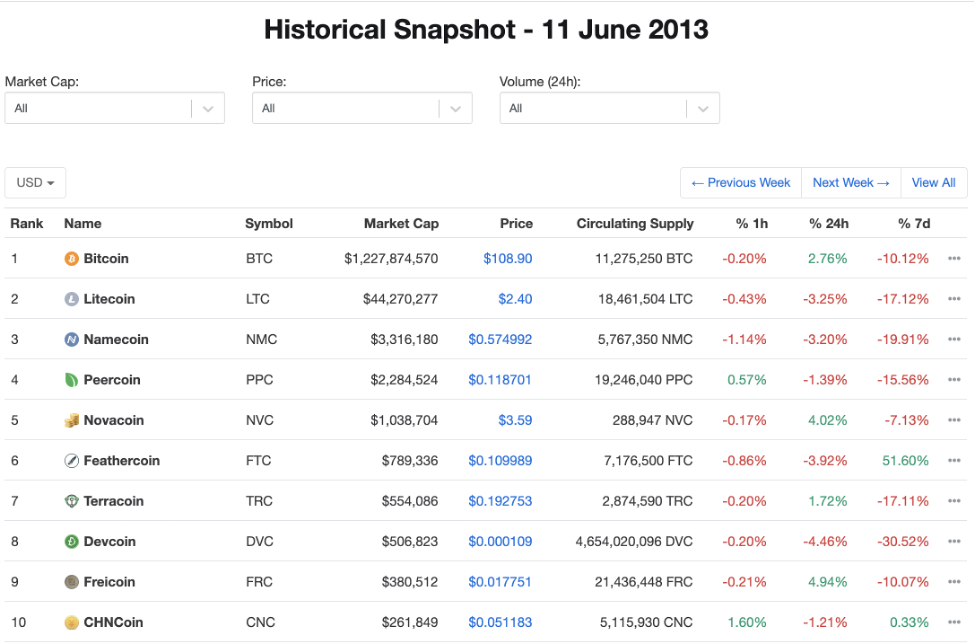

When AlphaPoint was founded in 2013, bitcoin was trading at a price of $107 and only about $5.3 million worth of bitcoin was trading per day, with about 50,000 transactions happening on the bitcoin blockchain daily. Investment into the industry was beginning to accelerate, with $93.8 million invested into startups in the space. Large financial institutions largely ignored or rejected the technology. Furthermore, the market capitalization of all coins was under $1.3B, with most of that market cap being dominated by bitcoin, and the rest of that market cap populated by a quite different altcoin landscape.

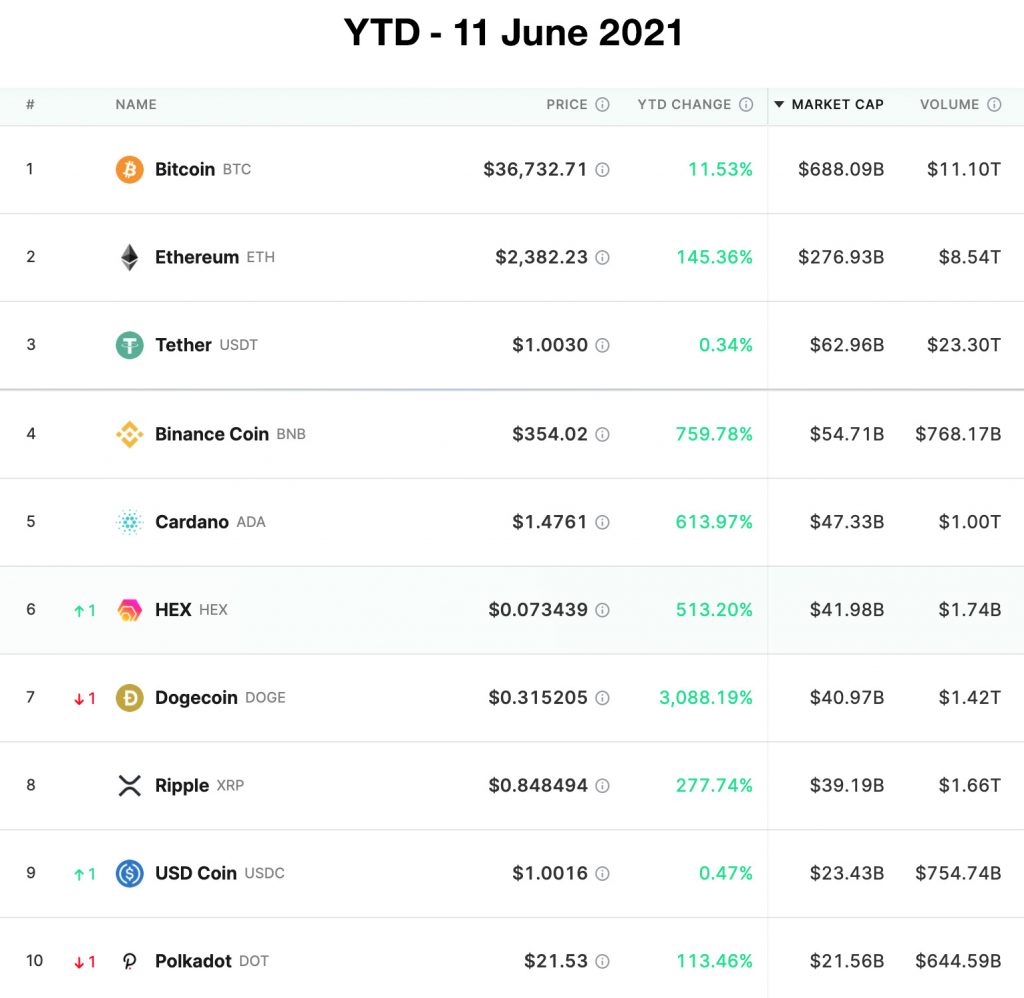

In our 8th year of operation, we’ve seen market activity explode on the heels of Bitcoin’s parabolic rise.

Bitcoin has quadrupled to $35k since June 11, 2020 when it was valued at $9208 and is still up ~25% since January 1 2021, despite this previous month’s sharp correction. Ethereum, which remains the second largest market cap asset ($280B), has skyrocketed 10x YTD, trading at $207 1-year ago and up 4X since January 1 2021.

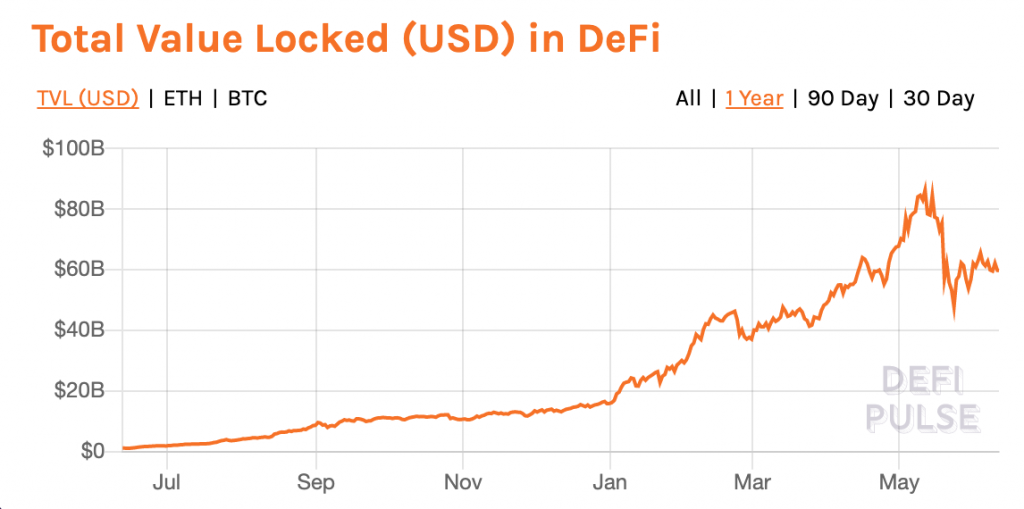

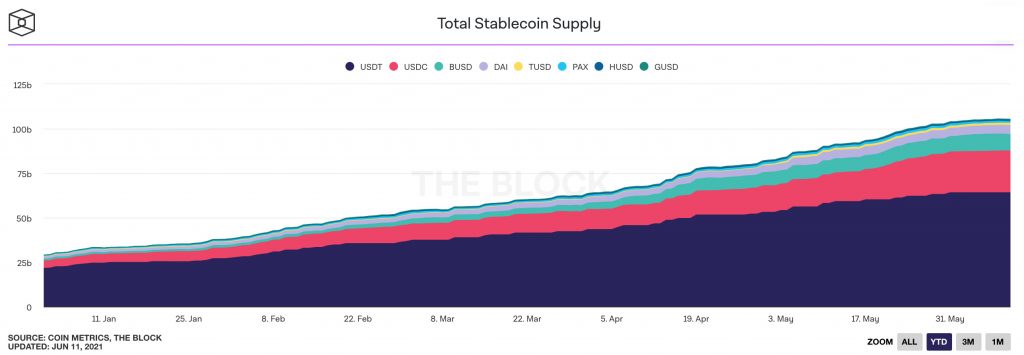

The YTD growth surge of DeFi is unprecedented, as there was only $1B locked in May 2020 and $88B at its peak this year. Now with $60B of total value locked in DeFi, we see the majority of investment spread across Maker, Compound, Uniswap and Aave. Interest rates for WBTC and stablecoins remain in the 5-10%+v range in DeFi.

WATCH: CEO Igor Telyatnikov talks market activity on CoinDesk TV’s FirstMover program (5/10/21)

Institutional interest in crypto has never been greater, with major custody solutions rolling out from Fidelity and Coinbase, and insured offerings from Bitgo and BNY Mellon entering the space. While this month’s outflows are significant with funds diverting back into traditional gold by institutional investors, Bitcoin remains a viable inflation hedge globally. Crypto developments at PayPal, Venmo and Square have expanded access to the asset class substantially, with roughly 46M Americans and 17% of adults purported to own Bitcoin.

WATCH: AlphaPoint on Nasdaq TradeTalks (5/27/21)

Year-to-date, our exchange clients posted record volume and net positive inflows, often doubling their posted inflows versus outflows during periods of high volatility. AlphaPoint clients cumulatively logged nearly $10B in trading volume across over 30M trades from about 1.4M end-user accounts total. Internally, we’ve successfully progressed 10 new exchange clients towards launch, and welcomed Eric Noll and Jon Kol to our Board of Directors. Like many companies in the industry, we’ve been scaling concurrent with industry growth, onboarding 8 new team members this previous quarter including new General Counsel Reba Beeson.

? We’re celebrating the anniversary with a few special items of swag. Check out our limited run of AlphaPoint 8-Year zip hoodies:

Did you grab one of our ‘Moon Rocket’ shirts at Bitcoin Miami? We distributed 850 pieces from our booth on the expo floor.

In Closing

Our goal remains to enable and empower our customers to provide access to digital assets globally. This requires continued investment in our underlying technology, customers, and team, while we grow.

We now know vastly more about crypto and blockchain than when AlphaPoint was first founded, but we still have so much to learn. We must remain vigilant and maintain a sense of urgency and dedication to addressing the industries challenges and be ready to seize new opportunities.

Sincerely,

The AlphaPoint Team

Dive into CaaS with our guide. Discover insights, benefits, and challenges for informed crypto decisions.

Over the last 15 years, blockchain and its associated technology have become widely known, accepted, and most importantly, trusted by crypto investors and enthusiasts. The use of exchanges, wallets, and other online platforms to transact crypto has grown. Unfortunately, so has the volume and sophistication of attackers interested in gaining unauthorized access, disrupting transactions, and […]

AlphaPoint celebrates 11-years as the leading provider of white label digital asset infrastructure.

Unbanked populations don’t just exist in underdeveloped countries. People without access to basic financial services also live in industrialized countries like the United States. Recent data shows that at least 6 million people in the U.S. are unbanked, as well as over 1 billion people across the globe. Financial exclusion leads to widespread issues like […]