AlphaBriefing - Institutional Insights

Stay in sync with the developments and narratives driving the institutional digital asset space.

In today’s rapidly shifting economy, you might wonder about your best hedge against inflation. What can you do to protect yourself and your business?

It’s an important question, as the U.S. Federal Reserve‘s historic quantitative easing (QE) during 2020 and 2021 (and subsequent inflation that continued through 2023), alongside hyperinflation in Venezuela and Argentina, illustrates the volatility and unpredictability of global financial markets.

As inflation rates soar to record highs in the U.S., savvy investors are exploring new avenues to preserve their wealth.

One emerging solution is digital assets.

This article outlines how these digital assets, along with other strategies, can provide a robust shield against the eroding effects of inflation. You’ll learn actionable tips to protect your financial well-being.

When inflation rises, the value of currency — like the U.S. dollar — falls, and each dollar can buy fewer goods and services. This reduction in purchasing power impacts your wallet directly. For instance, if the annual inflation rate is 5%, an item costing $1 last year now costs $1.05.

The Consumer Price Index (CPI) gauges inflation by tracking the price change of a basket of goods and services. A rising CPI means the prices of goods are increasing. It’s a clear indicator that your money won’t stretch as far as it used to. In response to inflation, interest rates may increase.

Banks and savings institutions offer interest on savings to keep pace with inflation. High interest rates mean it could cost more to borrow money but could also improve returns on money saved or invested.

Here’s a quick summary:

| If Inflation is… | Then Your Money… |

| High | Loses buying power more quickly |

| Low | Maintains value better over time |

With this in mind, the cash in your savings account is vulnerable because traditional savings accounts often don’t match the inflation rate.

In other words, inflation can eat into your savings even if you don’t spend a penny. Monitoring inflation and adjusting your savings and investment strategies is crucial if you want to safeguard your financial well-being.

A strategic approach to hedging against inflation safeguards the purchasing power of assets and helps with long-term business planning. Here are a few reasons why hedging is so important.

Your investment portfolio is susceptible to inflation, which can reduce the real rate of return on your assets. To shield investments from this decline, many incorporate a mix of asset classes like stocks and commodities that historically outpace inflation.

For example, Treasury Inflation-Protected Securities (TIPS) are designed to increase in value with the inflation rate, directly mitigating its effects.

When the CPI rises, your dollar buys less. Investors often turn to assets such as stocks whose share prices may increase with corporate earnings, thereby keeping pace with or exceeding inflation.

By doing so, you maintain, or even grow, your ability to purchase goods and services at current prices despite the devaluing impact of inflation.

Inflation can lead to higher costs and uncertainty. To foster stability, businesses actively manage their investment portfolios and adjust their pricing strategies to align with inflation trends.

Some corporations invest in commodities or real assets that typically appreciate with rising inflation, thus helping to offset the increased costs of doing business.

Managing debt efficiently is key when inflation rates are high. Fixed-rate debt, such as a mortgage, can become an advantage as inflation effectively reduces the real cost over time.

However, it’s vital for both companies and investors to closely monitor interest rates, as they typically rise alongside inflation and can affect the cost and strategy of both new and existing debt.

As inflation eats away at the value of money, you need to seek out investment strategies that can potentially maintain or increase your purchasing power.

So what’s the best inflation hedge? A single strategy isn’t ideal. Rather, a combined approach is your best bet against rising prices.

From government-backed securities to the diversity of the stock market, each of the following options offers a unique approach to protect your finances against inflation.

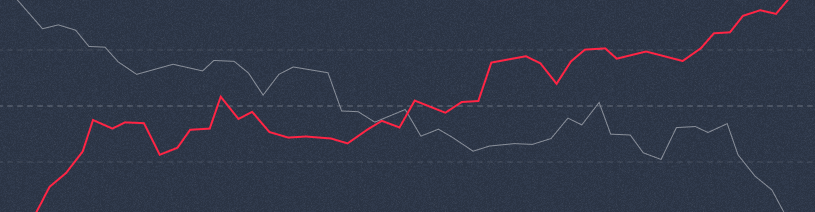

While high in volatility, cryptocurrencies like Bitcoin have gained popularity as alternative investments — and some traditional financial institutions are even beginning to offer digital assets.

Some investors consider them modern digital gold, potentially safeguarding value as they operate outside of conventional financial systems. But their market is still evolving, and regulatory developments can significantly impact their value, so we recommend a cautious approach.

It’s important to recognize the speculative nature of cryptocurrencies and their potential for high rewards, balanced against their significant risks. This makes them suitable for a portion of an investment portfolio geared toward high-risk, high-return assets.

Crypto exchanges can provide access to digital assets, simplifying the process of buying, selling, and trading and making it accessible to a larger population. Savvy businesses may even opt to establish their own turnkey crypto exchange to give customers access to digital asset services faster and more cost-effectively.

Investing in ETFs (exchange-traded funds) and mutual funds that target assets known to work as inflation hedges can help you build a robust, diversified portfolio.

These funds offer the advantage of professional management and the ease of diversification within a single investment, making them suitable for both novice and experienced investors seeking to mitigate inflation risks.

ETFs and mutual funds focusing on sectors traditionally resistant to inflation, such as natural resources or infrastructure, can be particularly effective. They provide both stability and growth potential, even during inflationary times.

Treasury Inflation-Protected Securities (TIPS) are a type of U.S. government bond that pays interest every six months.

The principal value of TIPS rises with inflation and falls with deflation, ensuring your investment adjusts to changing economic conditions.

Also, the interest payments on TIPS, though smaller, are more consistent, providing a reliable income stream for investors focused on preserving capital in uncertain economic times.

TIPS are particularly appealing during periods of high inflation forecasts. They offer a government-backed guarantee against the inflationary erosion of purchasing power, making them a cornerstone in any inflation-focused investment strategy.

By investing in the stock market, particularly in equities known to offer dividends, you can potentially outpace inflation. Over time, the stock market has shown resilience, often providing higher returns than inflation rates, albeit with higher risk.

Companies with a strong market presence and innovative products can be particularly resilient in inflationary climates.

Equities in sectors less sensitive to inflation, like technology or healthcare, can provide a good inflation hedge, as these sectors often experience robust growth independent of broader economic downturns.

A high-yield savings account offers better interest rates than traditional savings accounts. They keep your cash assets more productive and somewhat shielded from inflation’s impact, although still potentially fall behind long-term inflation rates.

These accounts are ideal for storing emergency funds or short-term savings. They combine the liquidity and safety of a bank account with a higher return potential.

Why is liquidity important? Liquidity offers flexibility, allowing you to quickly respond to changing market conditions or take advantage of new investment opportunities as they arise.

Investing in short-term bonds can be a safer approach to income generation, allowing you to avoid the longer-term risks that accompany long-term fixed income in an inflationary environment.

These bonds tend to be less sensitive to interest rate spikes and offer a predictable return, making them suitable for investors who prioritize capital preservation over high returns.

They also serve as an excellent way to diversify a portfolio, balancing more volatile investments and providing stability during times of economic uncertainty.

Historically, investing directly in commodities such as gold or oil has provided a buffer against inflation. Since commodities are tangible assets, they retain intrinsic value and often see price increases corresponding with inflation.

They offer a hedge not just against inflation but also against geopolitical instability and currency devaluation.

Commodities like agricultural goods or industrial metals can also diversify an investment portfolio, as their prices often move independently of stock markets and offer protection in varied economic scenarios.

Real estate can be an effective hedge against inflation as property values and rents typically increase with the cost of living.

Real estate investment trusts (REITs) allow for real estate exposure without the need to directly manage properties. Investing in real estate also provides you with potential tax advantages and a steady income stream from rental properties.

Real estate investments can also offer long-term capital appreciation potential, making them an integral part of a well-rounded inflation hedging strategy.

Creating a diversified investment portfolio that spans various asset classes, including stocks, bonds, real estate, and commodities, can spread risk and provide a multi-layered defense against inflation.

Diversification not only helps in managing risk but also enables you to capitalize on different economic cycles, maximizing the potential for returns across various market conditions.

An effectively diversified portfolio should be dynamically managed, taking into account changing economic indicators and adjusting the asset mix accordingly to optimize performance in the face of inflationary pressures.

When facing the challenge of inflation increases, you might feel like preserving the value of your money is a complex puzzle.

Luckily, financial institutions have various tools at their disposal to help shield your portfolio.

Here are a few tips to help you safeguard your assets:

Here’s a quick rundown of options:

| Inflation Hedge | Potential Benefit |

| Stocks | Can outperform during inflationary times |

| TIPS | Direct inflation protection for your bond investment |

| Real assets (REITs) | May appreciate with inflation |

| High-yield savings | Better interest rates to counteract inflation |

Remember, a proactive approach with your financial institution can make a huge difference in your investment outcomes during inflation.

Anticipating shifts in the digital asset landscape is tough and you need to be properly prepared.

AlphaPoint offers a highly secure digital asset exchange solution and brokerage technology to launch a platform for your investment management portfolio. Our system is backed by our advanced security certifications such as SOC 2, which is a testament to our commitment to safeguarding your clients’ investments. When you choose to build your digital asset infrastructure on our customizable platform, you gain access to:

As businesses and financial institutions continue to look for opportunities for their users to hedge against inflation, they can explore working with a partner like AlphaPoint to integrate a digital asset exchange solution and technology.

AlphaPoint’s modularity allows for the rapid launch of new crypto products, granting you a competitive edge against higher inflation. Get started with a demo today.

Stay in sync with the developments and narratives driving the institutional digital asset space.

The crypto derivatives market has experienced fast-paced growth, reaching a whopping $1.33 trillion in monthly trading volume. Part of this growth results from innovations like FalconX’s staking yield swap. But it’s also driven by investors’ need to hedge their portfolios against price fluctuations in the underlying spot market. You can take advantage of this growth […]

Ether exchange-traded funds (ETFs) have recently joined Bitcoin Futures ETFs on Wall Street, bringing more life to U.S. exchanges. On their first day on the exchanges, they registered more than $1.019 billion in trading volume, which is 23% of BTC ETF’s cumulative volume during its debut. While lower than BTC’s volume, the high number shows […]

Dive into CaaS with our guide. Discover insights, benefits, and challenges for informed crypto decisions.