Crypto as a Service (CaaS): Key Benefits, Providers, and Use Cases

Dive into CaaS with our guide. Discover insights, benefits, and challenges for informed crypto decisions.

Fill out the form below to view the COMPLETE report

Introduction

Methodology of Variables

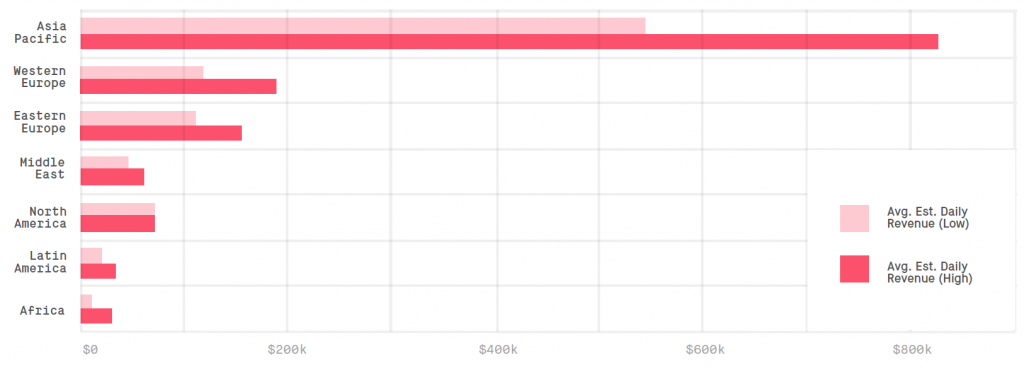

Maps

Macro Analysis

Individual Region Analysis (Asia Pacific, Africa, Western Europe, Eastern Europe, Latin America, Middle East, and North America)

Dive into CaaS with our guide. Discover insights, benefits, and challenges for informed crypto decisions.

Over the last 15 years, blockchain and its associated technology have become widely known, accepted, and most importantly, trusted by crypto investors and enthusiasts. The use of exchanges, wallets, and other online platforms to transact crypto has grown. Unfortunately, so has the volume and sophistication of attackers interested in gaining unauthorized access, disrupting transactions, and […]

AlphaPoint celebrates 11-years as the leading provider of white label digital asset infrastructure.

Unbanked populations don’t just exist in underdeveloped countries. People without access to basic financial services also live in industrialized countries like the United States. Recent data shows that at least 6 million people in the U.S. are unbanked, as well as over 1 billion people across the globe. Financial exclusion leads to widespread issues like […]