AlphaBriefing - Institutional Insights

Stay in sync with the developments and narratives driving the institutional digital asset space.

The financial ecosystem is increasingly recognizing the significance of digital assets, with Bitcoin at the forefront of this paradigm shift. In this context, the phenomenon of Bitcoin halving gains paramount importance, especially for exchanges, neobanks, and financial institutions aiming to integrate digital assets into their offerings. This guide explains the concept of Bitcoin halving, underscoring its pivotal role in the digital asset space.

To fully grasp the significance of Bitcoin halving, it’s essential to understand the fundamentals of this event and its role in the Bitcoin ecosystem. This section delves into the basics of Bitcoin halving, explaining what it is, when it occurs, and how it is hardcoded into Bitcoin’s protocol. By understanding these foundational concepts, exchanges, neobanks, and financial institutions can better navigate the implications of this pivotal event in the digital asset space.

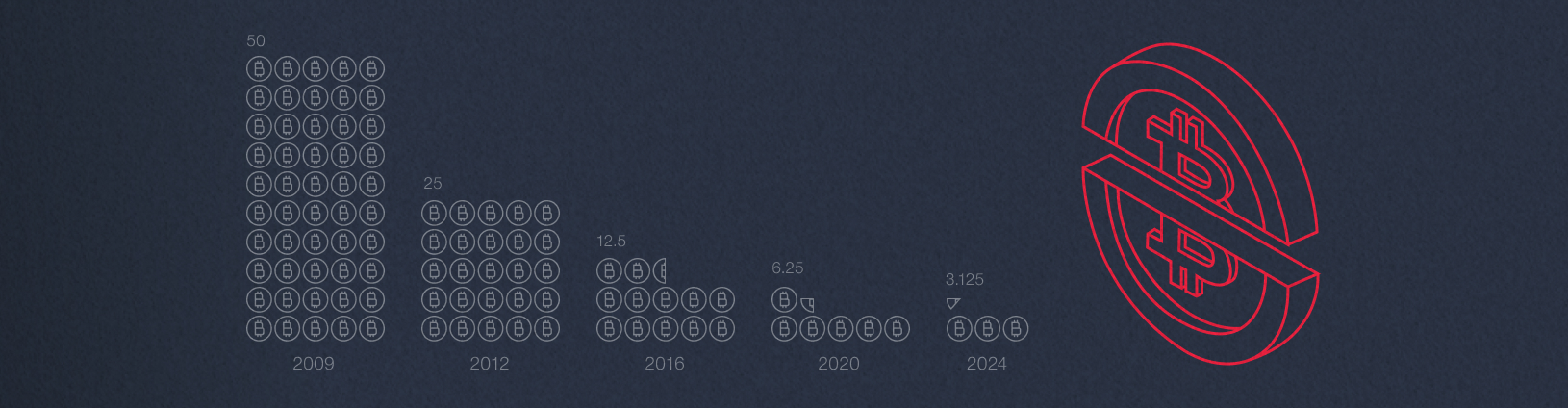

Bitcoin halving refers to the event that halves the rate at which new bitcoins are generated, effectively diminishing the block reward for miners by 50%. This event occurs every 210,000 blocks, or approximately every four years, ingrained into Bitcoin’s code by its creator to ensure a deflationary model.

The inception of Bitcoin in 2009 introduced a new era of decentralized financial systems, with the halving event embedded in its operation from the start. This mechanism ensures that Bitcoin’s total supply will asymptotically approach 21 million, making it a scarce resource and potentially increasing its value over time. The next Bitcoin halving will take place in 2024, around April 19th or 20th. Halvings have taken place approximately every four years, although the date of the next halving is to be determined.

We believe that the halving, combined with the recent approval of Bitcoin ETFs by the SEC, will bring significant attention and potential growth opportunities to the cryptocurrency space. The SEC’s approval of Bitcoin ETFs provides a regulated and accessible avenue for institutional investors to gain exposure to Bitcoin, bringing credibility and confidence to the market.

The halving process is a fundamental component of Bitcoin’s protocol. As miners validate transactions and add them to the blockchain, they are rewarded with bitcoins. The halving event decreases this reward, thus slowing down the rate at which new bitcoins are created and released into circulation.

The immediate consequence of halving is a reduction in the incentive for miners. This event can lead to a transient shakeout of miners with higher operational costs, effectively increasing the security and robustness of the network by favoring more efficient miners.

The Bitcoin halving event has far-reaching implications for exchanges and financial institutions operating in the digital asset space. As the halving approaches, these entities must prepare to navigate the potential market volatility and increased user interest that typically accompany this event. This section explores the impact of Bitcoin halving on exchanges and financial institutions, providing insights into historical market reactions and the importance of robust planning and analysis.

Past halvings in 2012, 2016, and 2020 have seen considerable surges in Bitcoin’s price, attracting heightened market interest. Exchanges and financial institutions should analyze these patterns to understand potential market dynamics around halving events.

While historical precedent suggests a bullish outlook post-halving, market dynamics are complex and influenced by broader economic factors. Institutions should hence approach speculation with caution, informed by robust market analysis.

Robust infrastructural planning and market analysis are crucial for exchanges and neobanks in preparation for the halving. Ensuring system scalability to handle increased transaction volumes and user engagement becomes paramount.

Educational initiatives explaining the halving process and its potential implications on market dynamics can empower users, fostering a more informed and engaged user base.

Bitcoin halving resonates beyond its immediate ecosystem, influencing the broader cryptocurrency and financial markets. It acts as a catalyst for discussions on decentralized finance (DeFi), monetary policy, and cryptocurrency adoption by mainstream financial institutions.

Halving events have historically sparked interest from traditional financial sectors and regulators, with an eye on the evolving regulatory framework and the mainstream adoption of cryptocurrencies.

Regulatory responses to halving events have varied, with some jurisdictions adopting a wait-and-see approach, while others use these events as touchpoints to reevaluate cryptocurrency regulations.

As Bitcoin and other cryptocurrencies continue to gain mainstream acceptance, increased attention from policy makers around future halving events will likely lead to more nuanced regulations. Ahead of the 2024 halving, the industry has experienced regulatory support for bitcoin ETFs and stablecoin legislation, along with regulatory backlash for bitcoin mining energy usage and asset classification debates over security versus commodity elsewhere.

Bitcoin’s halving events present unique opportunities for innovation and growth within the fintech and digital asset sectors. Companies can leverage these events to introduce new products, attract investment, and engage with a growing user base interested in digital assets.

Creative financial products and services designed around the Bitcoin halving cycle, such as halving-themed investment funds or derivative products, can provide new revenue streams and differentiation opportunities for digital asset companies.

The phenomenon of Bitcoin halving stands as a testament to the ingenious design of this cryptocurrency, emphasizing scarcity, reducing inflation, and potentially driving up value. As the digital asset space continues to evolve, understanding and leveraging the implications of the Bitcoin halving event can provide significant strategic advantage for exchanges, neobanks, and all stakeholders within the financial ecosystem. Embrace this pivotal moment in the digital asset space to innovate, educate, and grow.

Complete the form below to view the document.

Stay in sync with the developments and narratives driving the institutional digital asset space.

The crypto derivatives market has experienced fast-paced growth, reaching a whopping $1.33 trillion in monthly trading volume. Part of this growth results from innovations like FalconX’s staking yield swap. But it’s also driven by investors’ need to hedge their portfolios against price fluctuations in the underlying spot market. You can take advantage of this growth […]

Ether exchange-traded funds (ETFs) have recently joined Bitcoin Futures ETFs on Wall Street, bringing more life to U.S. exchanges. On their first day on the exchanges, they registered more than $1.019 billion in trading volume, which is 23% of BTC ETF’s cumulative volume during its debut. While lower than BTC’s volume, the high number shows […]

Dive into CaaS with our guide. Discover insights, benefits, and challenges for informed crypto decisions.