Crypto as a Service (CaaS): Key Benefits, Providers, and Use Cases

Dive into CaaS with our guide. Discover insights, benefits, and challenges for informed crypto decisions.

¡Haga clic aquí para la versión en Español!

An asset that maintains its value over time. Can be spent or exchanged at a later date without penalty.

Crises, such as hyperinflation, often expose vulnerabilities in the way citizens approach wealth storage.

If hyperinflation occurs, as has happened before in Peru from 1988 – 1991, would citizens be able to protect their wealth from rapid depreciation?

A store of value asset is meant to protect a citizen’s wealth during crises. In the past, gold has been treated as the preeminent store of value. When there is a regime change, war breaks out, or hyperinflation sweeps a country, citizens have historically bought gold to protect their wealth during turbulent times.

Peruvians have a rich history with gold, as the precious metal has been an effective store of value in Peruvian culture for thousands of years, dating back to the Incas. In traditional mythology, the Incas believed that gold was the sweat of Viracocha, their supreme god.

There are three central reasons why gold has historically been the strongest store of value:

Fungibility

Fungibility means that as long as the quantity of the asset is the same, the asset has consistent value regardless of its form. For example, I could cut a gold bar into 1 oz pieces, have 1 oz of gold jewelry, or 1 oz of gold coins and all those items would be worth the same value in terms of Peruvian sol.

Scarcity

In addition to being fungible, gold is also scarce. Scarcity means that the supply of the good is constrained. The supply of gold is more constrained than any other metal. Not only is there a limited amount of gold on earth, gold is extremely difficult to mine. Thus, gold will always be scarce. Unless we start mining gold in space of course!

Durability

Finally, gold is durable. Gold can be stored without deteriorating over long periods of time.

Bitcoin is a superior store of value to gold on many fronts. Like gold, bitcoin is incredibly fungible. One bitcoin is one bitcoin and each bitcoin is valued the same. While bitcoin is as fungible as gold, the digital asset is actually more durable than gold. Bitcoin will not deteriorate with time because it is digital. Additionally, bitcoin is far more portable than gold.

If one needs to seek refuge due to political turmoil or environmental disaster, bitcoin is easier to transport as it doesn’t have to be physically transported like gold.

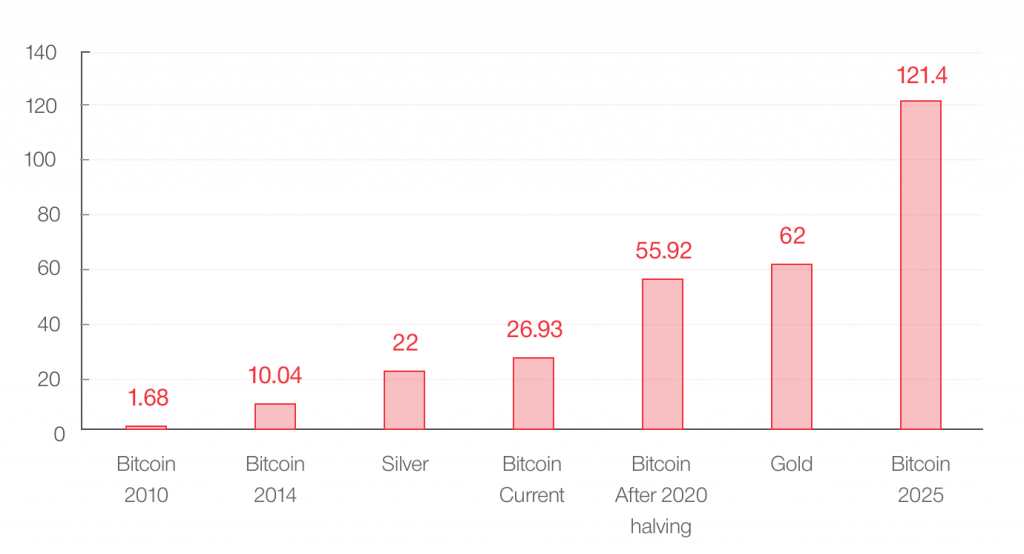

Finally, bitcoin will soon be scarcer than gold. One way to measure scarceness is the stock to flow ratio. “Stock” in this case means the total amount of the asset that has been hoarded rather than used, and “flow” in this context means the amount of new assets entering the market.

For example, approximately 171,300 tons of gold has already been mined and stored. This gold is not being used for jewelry or as parts in electronics. Estimations are that 2,750 tons of newly mined gold enter the market every year, which means gold has a stock to flow ratio of approximately 62 (171,300/2,250). No other metal has nearly as high of a stock to flow ratio.

Similar to gold, bitcoin also has an incredibly high stock to flow ratio. In fact, the maximum amount of bitcoin coming to market is capped at 21 million. Furthermore, roughly every four years the flow of bitcoin is cut in half in a ‘burning’ event coined The Halving.

Accessing Bitcoin in Peru

The primary way to buy bitcoin globally is via an exchange, with a Peruvian owned platform available for LATAM residents in Banexcoin. Banexcoin allows you to buy bitcoin with Peruvian sol directly, unburdened by high transaction fees when compared to the median across regional exchanges.

As a fluid access point to buy bitcoin, Banexcoin’s exchange also effectively stores customers’ cryptocurrency securely using advanced onboard wallet technology.

Banexcoin is a regulated exchange that operates with an approved license issued by the Superintendency of Banks (SBS), which is the Federal Reserve equivalent for Peru. Not only does Banexcoin have the appropriate licenses to operate an exchange against stringent financial guidelines, but Banexcoin also works directly with the Chamber of Electronic Commerce.

Finally, Banexcoin is active in the local bitcoin and cryptocurrency community. The founders are committed to actively educates users on all aspects of digital assets and the strategy needed t0 invest in them.

Banexcoin is a trusted gateway for Peruvians to access bitcoin with minimal capital investment.

Interested in trading on Banexcoin? Sign-up for a free account here: banexcoin.com/signup

Follow Banexcoin on Twitter at @banexcoin

Latin American Digital Asset Exchange Banexcoin Debuts Trading Platform

Dive into CaaS with our guide. Discover insights, benefits, and challenges for informed crypto decisions.

Over the last 15 years, blockchain and its associated technology have become widely known, accepted, and most importantly, trusted by crypto investors and enthusiasts. The use of exchanges, wallets, and other online platforms to transact crypto has grown. Unfortunately, so has the volume and sophistication of attackers interested in gaining unauthorized access, disrupting transactions, and […]

AlphaPoint celebrates 11-years as the leading provider of white label digital asset infrastructure.

Unbanked populations don’t just exist in underdeveloped countries. People without access to basic financial services also live in industrialized countries like the United States. Recent data shows that at least 6 million people in the U.S. are unbanked, as well as over 1 billion people across the globe. Financial exclusion leads to widespread issues like […]