Crypto as a Service (CaaS): Key Benefits, Providers, and Use Cases

Dive into CaaS with our guide. Discover insights, benefits, and challenges for informed crypto decisions.

The popularity of cryptocurrencies can’t be overstated. In 2023, the global crypto market cap is valued at $1.1 trillion. As more investors move to grow their crypto portfolios, crypto exchanges will be even more sought after.

In fact, developing a crypto exchange is a viable business venture, considering that the crypto market is expected to grow tremendously in the next few years. Nonetheless, starting a crypto exchange is a tough challenge that requires careful planning and a deep understanding of the market.

In this guide, we’ll explain the ins and outs of cryptocurrency exchange platform development to provide you with the information to get started.

Cryptocurrency exchange development is developing an exchange platform for cryptocurrencies, such as Bitcoin and Ethereum.

Since crypto exchanges operate digitally, developers must write the code and create a platform for users to trade multiple types of crypto. It’s essential for developers to create seamless and user-friendly exchange platforms.

These platforms should also be secure, following industry-leading security measures and legal standards in the fintech sector.

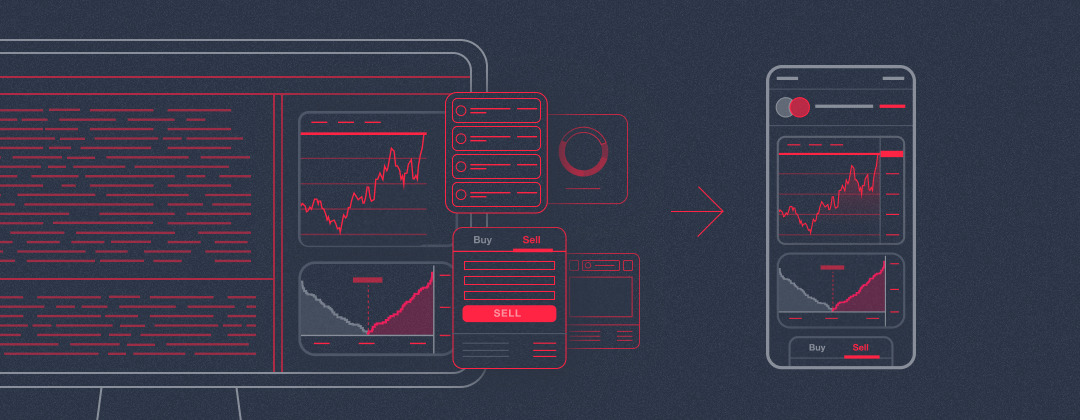

There are two types of crypto exchange development methods. The first is building a crypto exchange from scratch. Using this method, developers create an exchange platform without pre-set modules, creating software architecture from the ground up. Some developers prefer this option because they have unlimited freedom and customization options.

However, building a crypto exchange from scratch is a very complicated, time-consuming, and expensive process. As a result, some developers use a white-label product to develop a crypto exchange modularly.

This approach is less expensive and time-consuming, which helps developers bring their platform to market quickly. On top of that, white-label solutions provide both basic and advanced customization features suitable for all kinds of development teams.

A crypto exchange is a hub where investors can buy and sell crypto. By design, it’s similar to a stock exchange. When someone decides to buy a cryptocurrency, they’ll usually create an account with a crypto exchange.

There, they can buy crypto and sell them to grow their portfolio. Since crypto exchanges process tons of transactions every day, they need to have suitable liquidity to avoid volatility and maintain a regular market price.

In this sense, liquidity refers to the ease with which a person can convert a token or digital coin into cash or another digital asset. Crypto exchanges rely on liquidity pools to manage high-volume transactions without driving prices up or down.

Before exploring the basics of the crypto exchange development process, you should learn about the different types on the market. Below is a rundown of the various types of cryptocurrency exchanges.

Centralized crypto exchanges (CeX), like Coinbase and Binance, use a central authority to facilitate crypto transactions. These exchanges are user-friendly and easy for beginners to access digital currency.

A centralized exchange matches buyers and sellers together with an intuitive interface. However, there are some drawbacks to be aware of. For starters, centralized exchanges are susceptible to security breaches and hacks.

This is because all funds traded across the platform are held across their servers.

Finally, centralized exchanges usually require users to share much of their personal information, which can conflict with an investor’s privacy and damage user experience.

However, to the credit of centralized exchanges, they do comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) security standards to maximize security.

Decentralized exchanges (DeX) are the opposite of centralized exchanges. They don’t have a central authority managing them, which means investors make transactions through a peer-to-peer system.

Since decentralized exchanges don’t have a central authority, they’re much safer to use. Most users can also benefit from lower cryptocurrency trading fees. However, these exchangers aren’t typically beginner-friendly.

Decentralized Bitcoin exchanges are also vulnerable to low liquidity and trading volumes. If you were to have a dispute with the system, there is no intermediary to solve your conflict.

For decentralized exchanges to work, they rely on smart contracts to carry out autonomous transactions across blockchain technology.

A peer-to-peer (P2P) exchange allows people to trade directly with each other. These exchanges work like online marketplaces, enabling users to trade on their own terms.

P2P exchanges can suffer from low trading speeds and liquidity, but they’re usually very secure and don’t charge fees.

By now, you should know quite a bit about crypto exchanges and how they work. With that said, here are the key components that make any successful crypto exchange.

The first essential component of a crypto exchange is user registration and verification. This is a big deal because it forms the basis of how people will interact with your crypto exchange.

Ultimately, new users should be able to sign up and verify their identity easily using KYC security protocols.

Crypto exchanges naturally handle lots of private and sensitive financial information. They’re required to utilize industry-standard security measures. These include:

With these technologies, any crypto exchange can deliver traders a safe and positive experience.

The world’s governing bodies have not reached a universal consensus on the subject of crypto. Some countries allow crypto trading with certain regulations. Others have banned it completely.

When creating a crypto exchange, it’s crucial to be aware of your jurisdiction’s regulations to stay compliant. For example, by leveraging compliance tools, you can monitor and report suspicious activities, perform AML checks, and maintain necessary records.

It goes without saying that a crypto exchange needs to provide a seamless and easy-to-use UI. Without one, it’ll be difficult for users to trade with one another. Some common UI features include:

With these features, users can easily access commands and trade across your platform.

The trading engine of a crypto exchange facilitates all incoming and outgoing transactions. When you approach this task, you should design a trading engine that:

Your trading engine has the power to make or break your crypto exchange, especially since there are so many options on the market.

Any crypto exchange needs to have high liquidity pools. This way, users can buy and sell crypto across a crypto exchange without worrying about disruptive price fluctuations.

Liquidity is so important that some startups ensure it by partnering with other exchanges or by implementing market-making strategies for scalability.

The good news is that if you’re seeking to build a crypto exchange through a white-label partner, AlphaPoint gives its users instant access to a global network of liquidity.

Wallet integration allows users to deposit and withdraw their cryptocurrencies securely. Most crypto wallet integrations offer fiat Integration (if offering fiat-to-crypto trading) and support various payment methods, such as wire transfer, credit card, etc.

Building a successful crypto exchange means offering a versatile wallet integration to serve a wide variety of users.

Cryptocurrency exchanges rely on real-time market data and price feeds from various sources.

Accurate and up-to-date price information is essential for order matching and displaying cryptocurrency market data to users.

Because of this, a successful crypto exchange needs to leverage precise market data to offer real-time price feeds that ignite marketplace competition.

Given the increasing reliance on mobile devices, a dedicated app or mobile-optimized website is essential. Providing mobile application support allows crypto exchanges to offer a world-class experience on both desktop and mobile devices.

Offering efficient customer support makes it possible for users to settle time-sensitive disputes, which can elevate the customer satisfaction of your cryptocurrency trading platform.

Creating a crypto exchange is a straightforward process. Below are five crucial steps for successful cryptocurrency exchange software development.

Depending on where you and your users live, your platform will have to abide by a variety of different legal requirements. With that said, you should consult with an attorney to understand the legal requirements you’re required to uphold.

In order for people to use your platform, you’ll need to set up banking and payment integrations. These integrations make it possible for users to buy and sell cryptocurrencies throughout your platform.

Once you lay the foundation of your platform, you should equip it with an impeccable front-end UI/UX that’s highly functional, lightning-fast, and capable of handling high volume without crashing.

Before sending your crypto exchange to market, you should implement industry-standard security measures, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) for your platform.

Finally, you’ll need to promote your crypto exchange during and after its launch. You can promote your crypto exchange using digital marketing methods, such as social media marketing, paid advertising, and search engine optimization (SEO).

Building a crypto exchange is much simpler when you use a white-label solution. AlphaPoint enables users to take a convenient approach to blockchain development with the following features.

AlphaPoint’s platform has been battle-tested for over a decade and can be modified to meet your needs with over 500 APIs.

Build your digital asset infrastructure on a proven, customizable foundation.

AlphaPoint has obtained the highest levels of security certifications, including SOC 2, demonstrating our commitment to protecting our clients’ data and assets.

We employ industry best practices for ongoing monitoring and product security to enable your business to grow with confidence.

Liquidity is the lifeblood of a successful crypto exchange. By partnering with AlphaPoint, you can receive instant access to a wide network of liquidity pools to start and scale your crypto exchange.

We’re guided by leaders, innovators, and investors with expertise in areas like quantitative trading, machine learning, fixed-income trading and settlement, capital markets and leveraged credit transactions, data transparency, and FX derivatives.

With 10+ years of experience since our founding in 2013, we have been pioneers in believing crypto will transform finance. We remain at the forefront of innovation.

Our company is composed of experienced fintech innovators who are driven to solve the most pressing challenges facing our industry and committed to furthering the development and implementation of new technologies. Our experience brings real-world insights.

AlphaPoint offers versatile wallet solutions that offer hundreds of available cryptocurrencies. Whether you’re serving local or international users, you can give them trading options with digital tokens they care about.

Fully insured and incorporating industry-leading security standards, we are a company and platform you can grow with, as our software is highly configurable based on case-by-case client operational needs. Our infrastructure grows with you.

Our technology powers exchanges regulated by dozens of authorities globally, including customers operating under US FinCEN, Canadian CSA, Peruvian SBS, UK FCA, Philippines CEZA, Thai SEC, and many others

As you can see, there is a lot of time, effort, and expertise that goes into developing a successful crypto exchange. To make your job easier, it’s best to use cryptocurrency exchange development services like AlphaPoint.

AlphaPoint gives developers the choice to build their crypto exchanges in a modular way. If you’re ready to get started, request a demo today.

Dive into CaaS with our guide. Discover insights, benefits, and challenges for informed crypto decisions.

Over the last 15 years, blockchain and its associated technology have become widely known, accepted, and most importantly, trusted by crypto investors and enthusiasts. The use of exchanges, wallets, and other online platforms to transact crypto has grown. Unfortunately, so has the volume and sophistication of attackers interested in gaining unauthorized access, disrupting transactions, and […]

AlphaPoint celebrates 11-years as the leading provider of white label digital asset infrastructure.

Unbanked populations don’t just exist in underdeveloped countries. People without access to basic financial services also live in industrialized countries like the United States. Recent data shows that at least 6 million people in the U.S. are unbanked, as well as over 1 billion people across the globe. Financial exclusion leads to widespread issues like […]